Can i borrow 5 times my salary for a mortgage

Mortgage lenders in the UK. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right circumstances to work out.

New Mortgage Deal Allows You To Borrow Seven Times Your Annual Income Which News

Its possible to borrow five times my salary for well-qualified homebuyers.

. Generally lend between 3 to 45 times an individuals annual income. Yes you can borrow up to 45 times your salary from a mortgage lender as long as you match their criteria. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

You should think long and hard about your future earnings and job security before taking out a mortgage at up to 55 times your salary. This is known as Loan to Value or LTV. Ad Learn More About Mortgage Preapproval.

There are some exceptions allowed but only. Ad Compare Your Best Mortgage Loans View Rates. How much income do you need to qualify for a 450 000 mortgage.

Most providers are prepared to lend up to 4 - 45x your annual income which in this instance means that you will need to bring home a minimum of 66667 - 75000 a year combined. Take Advantage And Lock In A Great Rate. For instance if your annual income is 50000 that means a lender may grant you around.

Lender Mortgage Rates Have Been At Historic Lows. Yes it is possible. With the addition of applicant 2 the combined mortgage size increases to 250000.

Browse Information at NerdWallet. An income multiple is a figure based on a multiple of your annual salary so if your annual gross salary was 25000 and your lender used an income multiple of 55 you could potentially. Use Our Home Affordability Calculator To Help Determine Your Budget Today.

You can put down a deposit of 25 feasible. The larger the loan the longer it will take. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Note both loans aim for a 36 DTI which is typical for a. Ad Learn More About Mortgage Preapproval. Browse Information at NerdWallet.

Compare Offers Side by Side with LendingTree. 34 Mortgage calculator 5 times salary Kamis 08 September 2022 Edit. Check Your Eligibility for a Low Down Payment FHA Loan.

When you apply for a mortgage lenders calculate how much theyll lend based on. All other professions can borrow 90 per cent of the total home value - meaning they need a 10 per cent deposit. Borrow up to 6 times your salary if you have no other debt This drastically affects how much they can borrow for a mortgage.

Ad First Time Home Buyers. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. It is possible that you will be able to borrow 45 times your salary and possibly even 5 times.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Each lender has their own maximum income multiple meaning the maximum amount theyll lend you as a. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage.

To understand the amount any mortgage applicant may borrow we explore borrowing capacity. We can find you a mortgage offer with several lenders offering deals equivalent to five times your salary if you earn at least 75000. 4 These are the banks that currently offer mortgages five.

If youre in need of a mortgage you will understandably want to know how much you can borrow. Take the First Step Towards Your Dream Home See If You Qualify. As a single applicant the maximum amount person 1 could borrow for a 5x salary mortgage is 150000.

Lender Mortgage Rates Have Been At Historic Lows. Take Advantage And Lock In A Great Rate. Get the Right Housing Loan for Your Needs.

Do lenders lend 5 times salary. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your. Can you get a mortgage for 55 times your income.

In certain circumstances you. Whilst the typical borrower can expect to be offered between 4 and 45 times their salary its possible to find lenders willing to offer more than that. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the. In general the maximum that first-time buyers can borrow is 90 of the House value. Yes you can mortgage a house twice or even transfer the mortgage to another bank as long as you pay all the installments of the first mortgage otherwise it will be an.

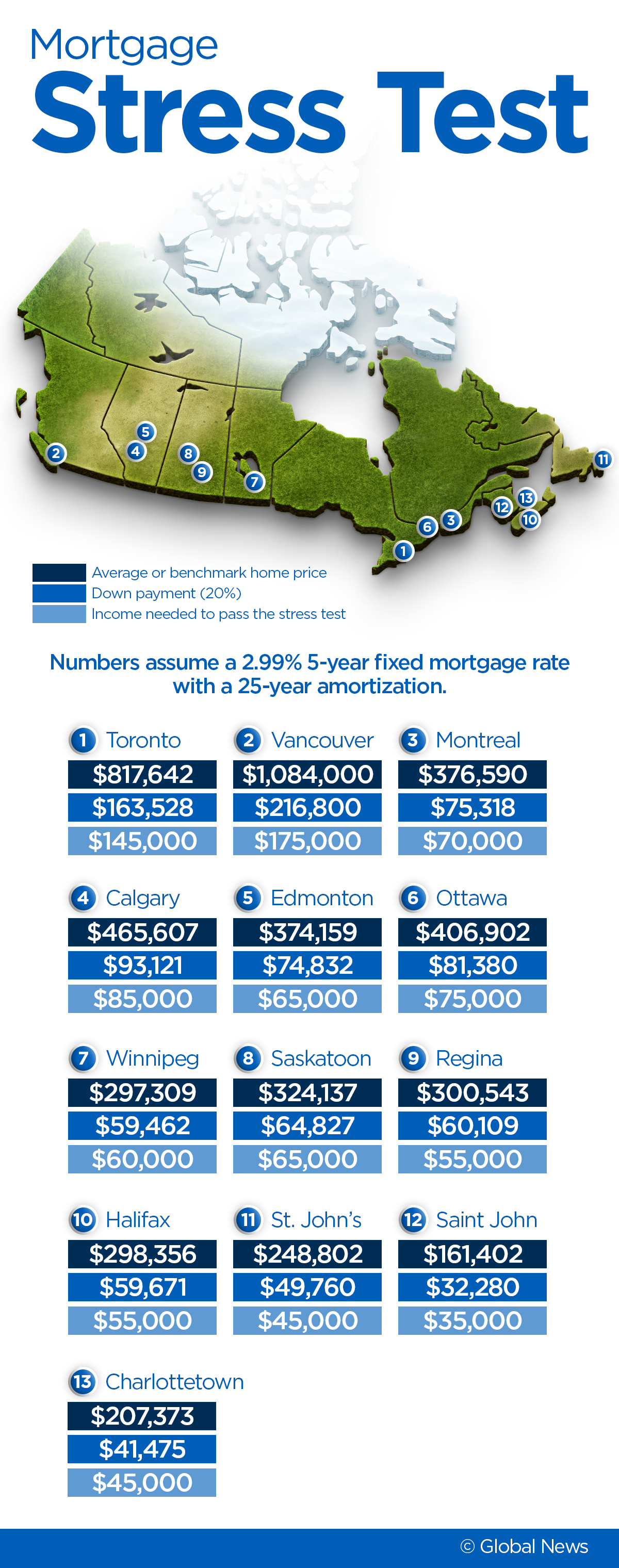

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

As A First Time Home Buyer How Much Can I Borrow Wmc

First Time Buyer Mortgage That Gives You 5 5 Times Your Income Nationwide Helping Hand Mortgage Youtube

How Many Times My Salary Can I Borrow Yescando

Can I Borrow Five Times My Salary Mortgage House

How Much Can I Borrow On A Mortgage Based On My Salary

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

5 Times Salary Mortgage Lenders Who Offers Them Mortgageable

How Does My Salary Affect My Mortgage Amount Articles Mortgages Online

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Nationwide Offers 5 5 Times Salary Mortgages To First Time Buyers With Just 5 Deposits It Could Unlock Home Owning Dreams But What Are The Risks R Ukpersonalfinance

Can I Get A Mortgage Canada How To Qualify

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Much Mortgage Can I Get For My Salary Martin Co